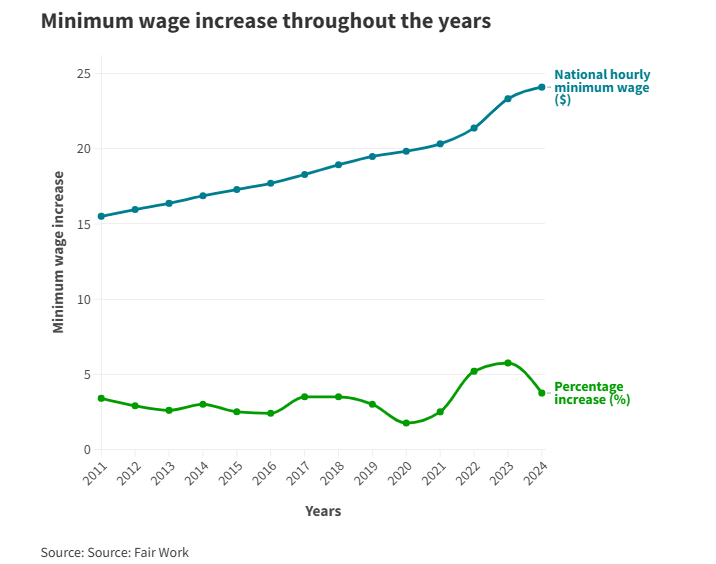

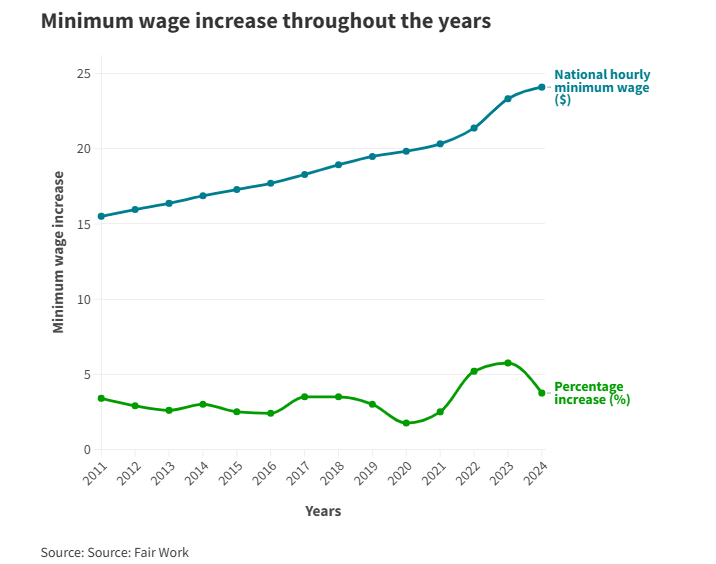

With the start of the new financial year, many Australians received a slight boost to their income as the minimum wage increased by 3.75 per cent.

Earlier this year, the Fair Work Commission announced the minimum wage increase to aid with the cost-of-living pressures, which impact about 22 per cent of the workforce, primarily women and casual workers.

Housing is a significant factor in the ongoing cost of living crisis, so raising wages seems like an injection of cash that could boost the property and rental market.

However, that’s not necessarily the case. The increase to the minimum wage happens every year so that wages can keep up with inflation, and this year’s increase is much smaller than last year when the national minimum wage rose by 5.75 per cent (the largest in at least a decade).

Will the minimum wage increase affect property prices?

Sean Langcake, head of macroeconomic forecasting at BIS Oxford Economics, says the minimum wage increase is supposed to help with cost-of-living pressures. While putting money into people’s pockets equals higher inflation figures and prices, it won’t necessarily significantly affect property prices.

“It certainly helps people keep up with their rents and their mortgage costs,” he says.

“As to whether that translates to a surge in demand for the housing market, I think it would be pretty tame at this point because people are getting kind of used to the idea that they’re going to be a bit higher for longer.”

Domain’s chief of research and economics, Dr Nicola Powell, agrees.

“The minimum wage increase is still behind inflation,” she says. “It’s not going to really impact the housing market. But it’s going to help those individuals who are on minimum wage.”

However, Mozo finance expert Rachel Wastell says any income increase can positively affect borrowing capacity.

“Raising the minimum wage can positively impact home loan serviceability by increasing borrowers’ disposable income, helping them better manage expenses and meet mortgage repayments. This, in turn, can make them more attractive to lenders.

“However, lenders assess loan serviceability based on various factors, including overall income, existing debts, and long-term financial stability. While a higher minimum wage increases income, it doesn’t always guarantee better loan serviceability.

“Lenders will look at the broader financial picture, considering rising living costs and interest rates, which could offset the benefits of a wage increase. Inflation, which erodes real wage growth, also plays a significant role.”

Will the minimum wage increase affect rental prices?

Dr Christopher Phelps, a research fellow at Curtin University, says increasing incomes should improve rental affordability or push up rents, but that’s not always the case.

“This wage increase targets some of the poorest households in Australia, who represent a small fraction of the private rental market. Very few private rental properties are affordable for this group,” he says. “It’s unlikely to result in a significant increase in their capacity to afford more expensive rental accommodation or impact upon prices.

“With rising costs of living, such as for food and healthcare, much of the additional income from the wage increase is likely to be – or has already been – absorbed by these expenses.”

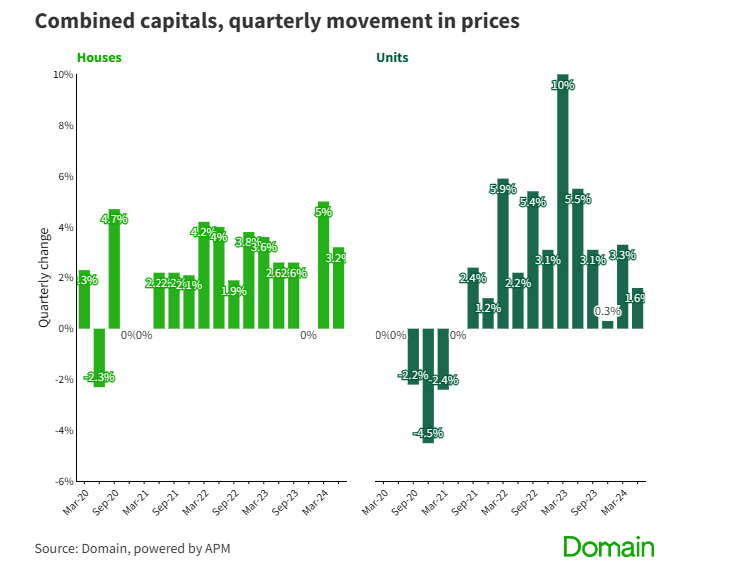

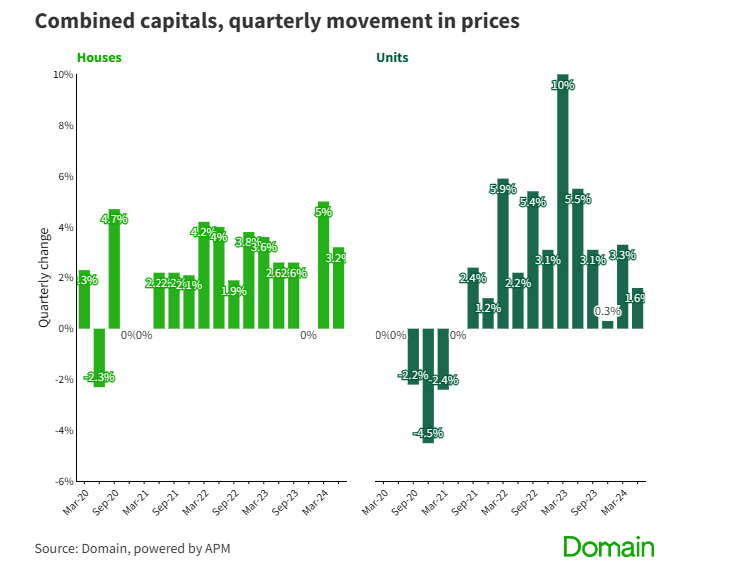

In the past year, house rents have risen by 11.1 per cent, while unit rents have grown by 8.6 per cent, according to the Domain Rent Report.

“A single person on the minimum wage could afford 0.6 per cent of properties. A couple with two children could afford 13.4 per cent of properties, down 2.5 per cent from last year.

“In 2012, [a family on minimum wages] would have been able to afford just over 30 per cent of all properties … In the past decade, this has more than halved.”

Article Source: Click Here