Article Source : Click Here

Nerida Conisbee

Ray White Group

Chief Economist

Australia’s housing market has recorded its second consecutive month of price growth in February 2025, with the latest data showing momentum building across both houses and units nationwide.

While most data companies are suggesting that growth only commenced in February, Ray White’s analysis reveals that the market actually began its upward trajectory in January, as buyers started pricing in the rising potential for interest rate cuts.

Growth spreads across the country

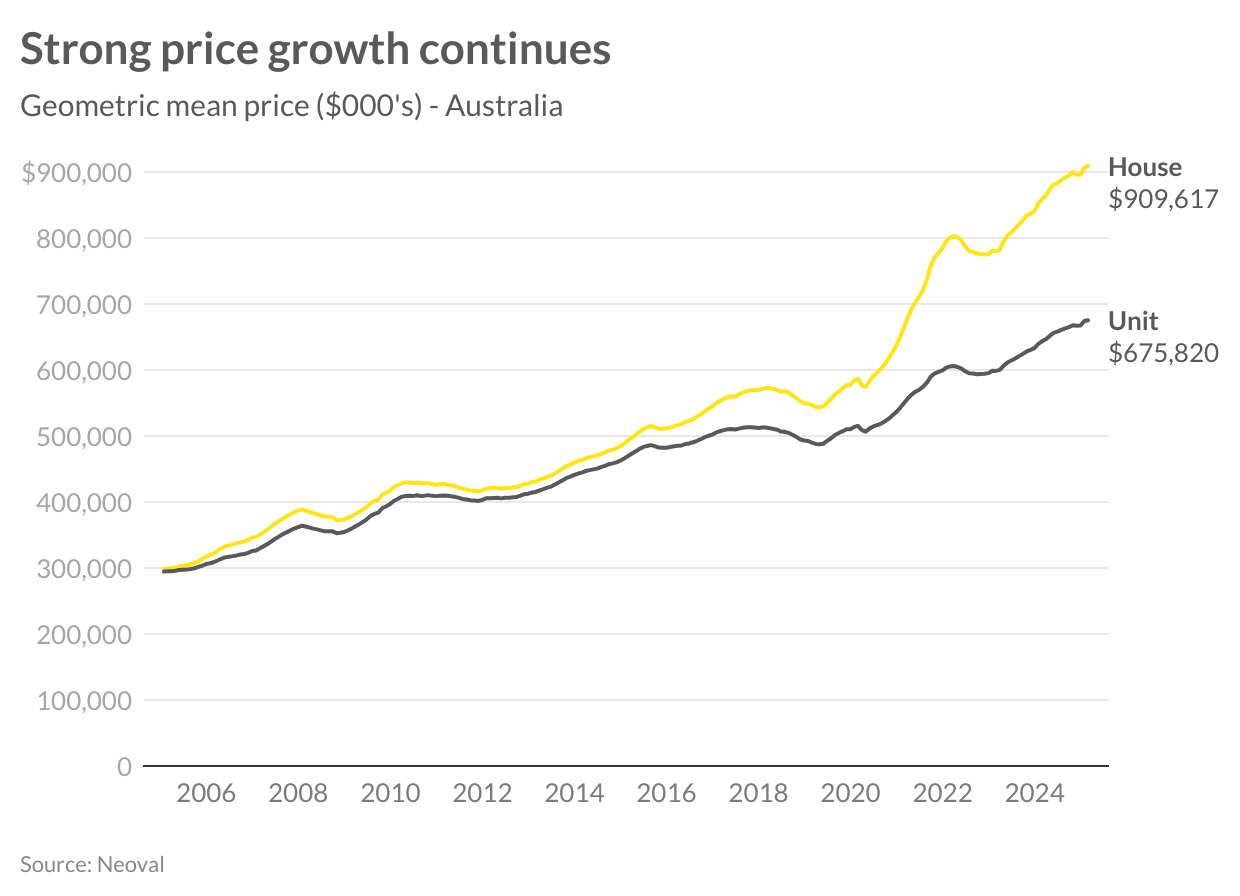

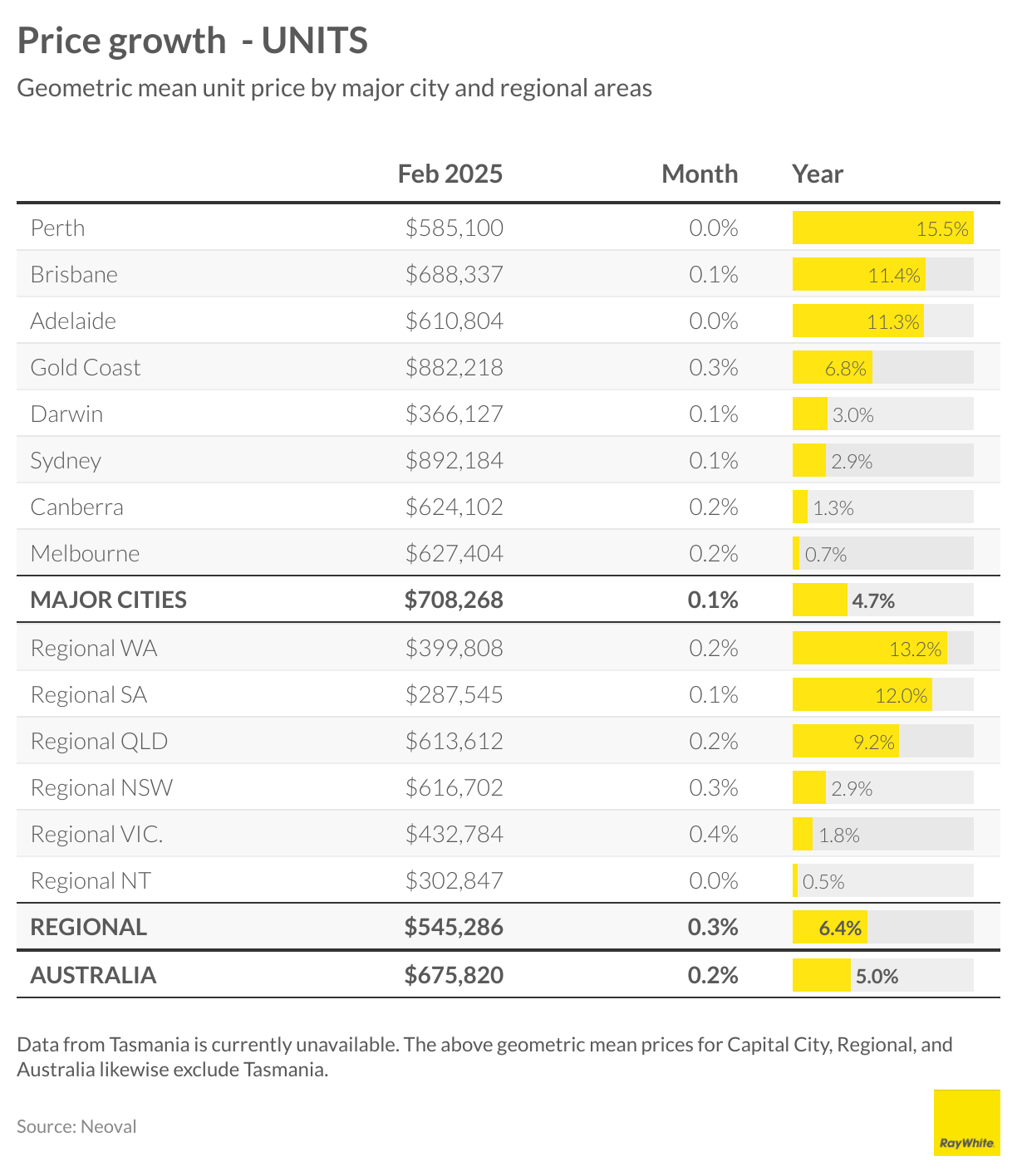

February data shows the Australian housing market is continuing the growth pattern established in January, with house prices rising by 0.2 per cent month-on-month to reach a national median of $909,617, representing a yearly growth of 5.8 per cent. The unit market similarly saw positive movement with prices increasing by 0.2 per cent to $675,820, delivering an annual growth rate of 5.0 per cent.

Perth continues to lead the major capitals with remarkable annual growth of 14.9 per cent for houses and 15.5 per cent for units. Brisbane and Adelaide maintain their strong positions with houses in these cities seeing annual growth of 8.8 per cent and 9.1 per cent respectively, while their unit markets posted even stronger performances at 11.4 per cent and 11.3 per cent.

Regional areas continue to show strength, particularly in Western Australia and South Australia, where regional house prices have surged by 13.3 per cent and 11.3 per cent respectively over the past year. The two-speed market persists with Melbourne and Canberra experiencing more modest growth.

January’s overlooked turnaround

While many analysts are pointing to February as the start of the market’s recovery, our data clearly shows that January marked the true turning point. This earlier-than-recognised momentum suggests buyers were already responding to changing economic signals, particularly the increasing likelihood of interest rate cuts.

Housing super cycle underpins long-term growth

The current price growth should be viewed through the lens of Australia’s housing “super cycle” – a long-term structural trend that transcends traditional market cycles. Unlike typical housing cycles driven primarily by interest rates or market sentiment, this super cycle stems from deep structural changes creating persistent imbalances between supply and demand.

Australia continues to face a significant undersupply of housing, with last year’s completion of 209,000 homes falling short of the required 220,000. This shortfall is compounded by demographic shifts and evolving living preferences that the construction industry is struggling to address.

The construction sector faces mounting challenges including rising business failures, declining productivity, and construction costs outpacing house price growth. Meanwhile, Australia’s predominantly low-density cities make it difficult to efficiently meet changing housing needs compared to international counterparts.

These structural constraints effectively create a floor for housing prices and limit the potential for significant price reductions. Even without interest rate cuts, these fundamental factors are expected to maintain upward pressure on prices in the medium to long term.

Future rate cuts face new uncertainties

While expectation of interest rate cuts helped fuel the market’s January revival, the outlook for monetary easing has become increasingly uncertain. Rising economic troubles in the United States and higher levels of global protectionism are introducing new variables that could potentially reignite inflation.

The path to interest rate cuts is becoming less clear as global economic headwinds intensify. However, Australia’s housing market has demonstrated remarkable resilience, with the largest price drop in the last 20 years being just five per cent. This structural strength suggests continued price growth is likely even without immediate monetary easing.

Market outlook remains positive

The combination of January’s overlooked growth, February’s continued momentum, and the underpinning effect of Australia’s housing super cycle points to a positive outlook for property prices. While occasional market fluctuations will occur, the persistent structural imbalance between supply and demand will continue to shape the market for years to come.

For those hoping for more affordable housing, the outlook suggests continued price growth, albeit with occasional brief periods of decline. We appear to be experiencing a fundamental shift in the property market’s dynamics, where traditional cycles of significant ups and downs are being replaced by sustained long-term price growth, interrupted only by brief corrections.

Download graphs and image of Nerida Conisbee here

Media contact

Nerida Conisbee

Ray White Group

Chief economist

nconisbee@raywhite.com

0439 395 102

Article Source : Click Here